Energy Tests

Energy tests assess candidates on the skills and aptitudes that are essential for positions in the energy industry.

There are many different roles that are part of the insurance industry, from working in a customer service role to managing accounts, sales and marketing, and other business functions. Finding the right candidates for these roles needs specific data on their capabilities, skills and knowledge - so that the right hires can be made.

Try for freeAn insurance test is used to assess the specific skills and competencies that are needed in the job - and by asking the right questions, the assessment allows recruiters to choose the top-performing candidates to take forward.

The tests are typically timed and usually consist of a number of questions with multiple-choice answers. These tests are delivered to the candidates via an email link and completed online within a certain time period.

Pre-employment assessments like the insurance test are becoming more commonly used because they offer a simple way to differentiate between similarly qualified candidates, providing quantifiable results that are free from hiring bias. The results simply tell recruiters which candidates have the right skills, avoiding the risk of taking forward candidates who are unlikely to be successful in the role.

To do well in this assessment, a candidate needs to answer the questions quickly and correctly, demonstrating their abilities and competencies.

The insurance test is based on the aptitudes that are needed for success in a role in the insurance industry.

As it can be administered to multiple candidates at the same time, it is useful for recruiters who need a data-driven way to shortlist candidates. As the tests are standardised, the questions are the same no matter who is taking the test, which means there is fairness in the results.

For the recruitment team, this quantifiable data is invaluable in reducing the risk of making a bad hire - knowing that there is data on the top-performing candidates that have the necessary skills, competencies and attributes to be successful in the position empowers recruiters with further insight.

Pre-employment testing is usually applied after the initial paper sift of applications and CVs for a job role. Once the candidates who meet the basic criteria have been screened, they take the test via email.

Skills that can be assessed by an insurance test include:

In traditional recruitment processes, the required skills and competencies would have to be assessed either through the information given by the candidate in the application form or in the CV. It could also be gained through asking the right questions in an interview - but the real problem is proving it.

The insurance test is a collection of questions that allow a candidate to demonstrate that they have what it takes to meet the requirements of the role, and to be successful, too. The insurance test is suitable for roles like:

The insurance test is simple to administer, straightforward for the candidates to answer and provides data that helps recruiters make the best decisions about who to employ.

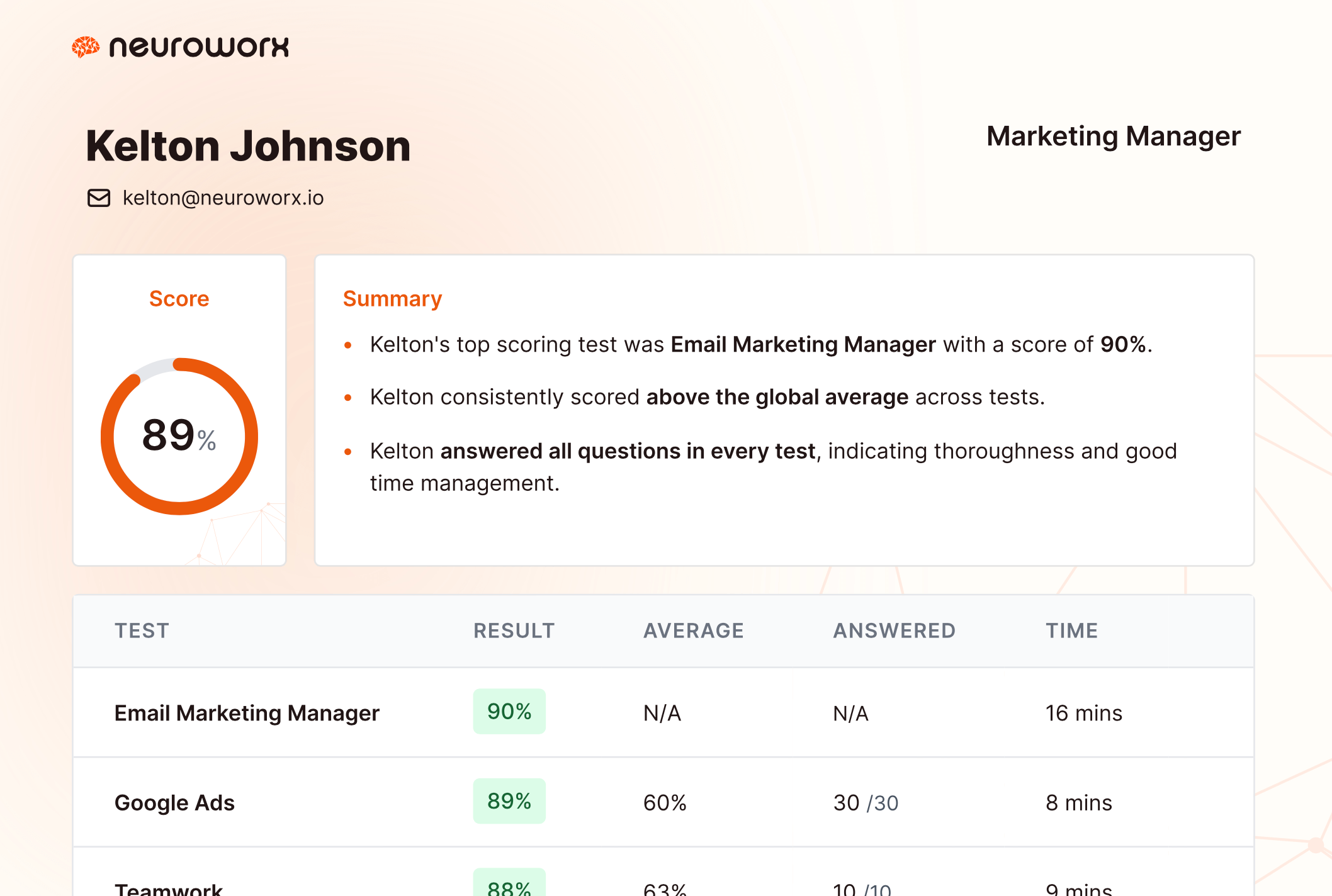

Results for the Insurance Test along with other assessments the candidate takes will be compiled to produce a candidate report.

The report is automatically generated and available both online and as a downloadable pdf so they can be shared with other team members and employees alike.

There are a number of different test types that would be useful for recruiters filling a role in the insurance industry.

The ability to work with numbers is important throughout the insurance industry, and while the numerical reasoning assessment is not strictly a maths test, it does test a candidate on how comfortable they are when dealing with numerical data.

Presenting several questions in the form of tables or graphs, the candidate needs to quickly read, understand and analyse the data to find the right answers. The candidate might need to complete some basic mathematical operations to answer correctly.

Like the other psychometric tests, the numerical reasoning assessment is timed and has multiple choice answers.

In a verbal reasoning test, the candidate is presented with a passage of text, usually related to the job role. They will need to quickly and accurately read, understand and analyse the information in the passage to answer a question. The question will have multiple choice answers and there is no previous knowledge needed to answer.

This test is a great indicator of a candidate's ability to read and communicate well and shows that they can reach accurate conclusions based on written information.

A personality test is designed to assess a candidate based on their personality traits and behaviour at work. It is useful for recruiters to ensure that candidates are suited for the role in terms of their personal preferences, but also allows them to demonstrate how they would fit in with the workplace culture too.

Personality tests tend to be structured as a group of statements that the candidate needs to rate on a scale of how much the statement refers to them. It is usually untimed.

Job knowledge tests are designed to test the candidate based on the specific skills and knowledge that is necessary for the role. Sometimes skills tests are used, and these require a candidate to demonstrate or prove their ability.

Skills and job knowledge tests can be in areas as different as typing speed to programming languages, but they all have the same purpose for the recruitment team - to ensure that the candidates have the required level of competency.

Our test platform

Our platform offers an extensive library of hundreds of tests, giving you the flexibility to select and combine them in any way that suits your hiring needs. From understanding specific role requirements to assessing general cognitive abilities, our diverse library ensures you can tailor your assessment process precisely.

The typical recruitment process in the insurance industry starts with an application form and CV. The candidates who meet the initial criteria are invited to complete online psychometric testing, followed by telephone or face-to-face interviews.

A candidate for an insurance role needs the following skills:

We believe in simple, transparent pricing. We operate monthly and annual subscriptions so you can pick the perfect plan for you. Don't worry if you're not sure: you can always upgrade or downgrade later, or speak to us to discuss the option of a custom made plan to fit your needs. This is all you ever pay – no set-up or hidden fees.

Yes, sign up (no credit card required) and we'll give you a 7-day trial completely free. You'll get unlimited access to create as many jobs and test as many candidates as you like. You can cancel any time and you won't be charged anything.

Energy tests assess candidates on the skills and aptitudes that are essential for positions in the energy industry.

Clerical tests evaluate the skills, aptitudes, and characteristics of applicants for a clerical position.

Retail tests evaluate the skills and characteristics of applicants for a given position in retail.

Restaurant tests determine the skillset and personality traits of individuals applying for a restaurant-based job.

Talk is cheap. We offer a 7-day free trial so you can see our platform for yourselves.

Try for free