Social Worker Test

Social worker tests are designed to assess candidate aptitude in the skills necessary to work as a successful social worker.

Insurance adjuster tests are designed to assess candidates on the requisite skills and aptitudes to determine their suitability for the role of insurance adjuster.

Try for freeAn insurance adjuster is a core role within insurance companies, governments, agencies and more. They are responsible for investigating, evaluating and settling insurance claims on behalf of companies, by deciphering who is liable for the claim.

An insurance adjuster test is used to assess whether a candidate has the essential skills required to succeed in such a role. Employers can use this test in the early stages of the hiring process to ensure they proceed with the most skilled applicants.

Each candidate is evaluated by a series of multiple-choice questions. The insurance adjuster test measures an individual’s critical thinking, analytical, verbal and logical reasoning skills, as well as their ability to hold sound judgement over a complex scenario.

A high score on this test suggests a candidate would make a productive, confident addition to your insurance team and be able to reach a logical, fair conclusion for all parties involved.

An insurance adjuster is responsible for investigating insurance claims and ensuring the correct parties receive a fair settlement for their claim through negotiation. This includes consulting with witnesses, reviewing police reports and compiling all evidence available to come to a just decision.

This test assesses whether candidates for an insurance adjuster role possess the required level of critical thinking, verbal reasoning, analytical skills and attention to detail to be successful.

Naturally, you want to shortlist the most suitable candidates for your insurance adjuster position. However, differentiating between applicants based on their resumes alone can seem an impossible task, particularly as the role requires such a broad skill set.

An insurance adjuster test removes this challenge and gives employers the ability to distribute skills tests to large numbers of candidates and receive comparative data to analyse. The results will give a clear and unbiased insight into how well suited each applicant is, creating a more streamlined hiring process.

The test will highlight how adept a candidate is with the essential skills required of an insurance adjuster, such as sufficient communication skills for liaising with a diverse range of clients and claimants, and the ability to analyse complex insurance claims. It will also measure their attention to detail, verbal and logical reasoning abilities, and general computer skills.

Applicants that meet the requirements of the role can be shortlisted, while those who do not can be excluded.

An insurance adjuster test could also be useful for the following roles:

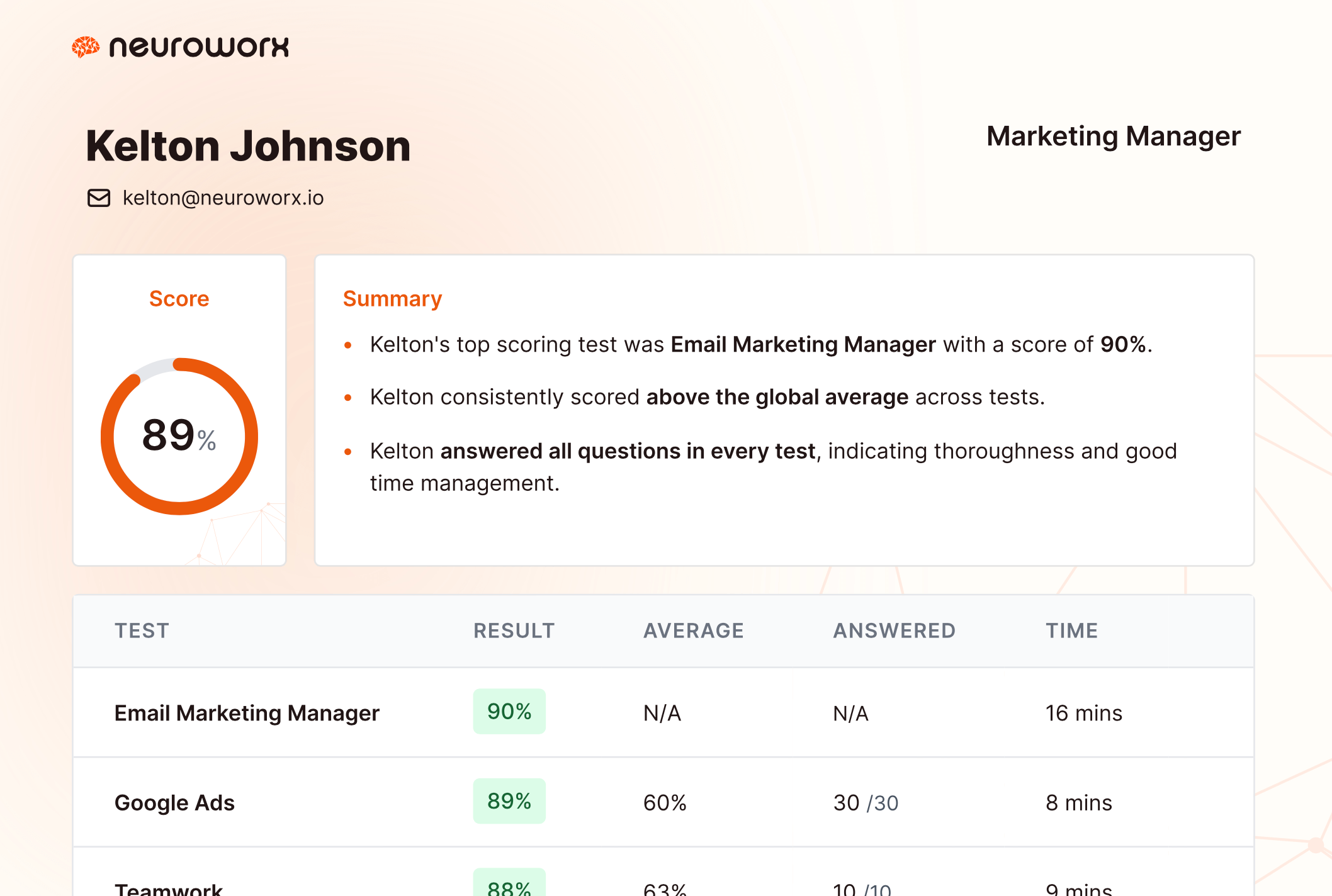

Results for the Insurance Adjuster Test along with other assessments the candidate takes will be compiled to produce a candidate report.

The report is automatically generated and available both online and as a downloadable pdf so they can be shared with other team members and employees alike.

Candidates will need to answer a range of questions that measure industry-specific technical skills where applicable (e.g.Microsoft Excel), soft skills (e.g. interpersonal skills), aptitude (e.g.numerical reasoning) and relevant personality dimensions (e.g. detail orientation). The results present a holistic view of how well suited each candidate is for the job at hand, using a data-driven approach.

The format varies by type of question, including multiple-choice for aptitude and technical skills, situational judgement for soft skills and agreement on a Likert scale for the personality dimensions. This approach ensures candidates are being assessed in an accurate and fair manner, and that results reflect the true underlying qualities of each candidate.

The characteristics, abilities and knowledge necessary to be an insurance adjuster were identified using the US Department of Labor's comprehensive O*NET database. O*NET is the leading source of occupational information that is constantly updated by collecting data from employees in specific job roles.

During the development process, test questions were rigorously analysed to maximise reliability and validity in line with industry best practices. They were created by our team of I/O psychologists and psychometricians – who collaborated with subject-matter-experts – and field-tested with a representative sample of job applicants who have varying experience, just like you might find in a talent pool.

Each test is reviewed by a panel of individuals representing diverse backgrounds to check for any sensitivity, fairness, face validity and accessibility issues. This ensures each candidate has a fair chance of demonstrating their true level of expertise.

Our insurance adjuster test is monitored to ensure it is up-to-date and optimised for performance.

Our test platform

Our platform offers an extensive library of hundreds of tests, giving you the flexibility to select and combine them in any way that suits your hiring needs. From understanding specific role requirements to assessing general cognitive abilities, our diverse library ensures you can tailor your assessment process precisely.

The key skills required to be successful in an insurance adjuster role include:

The insurance adjuster test is best used at the beginning of the application process, either before creating an initial shortlist or following it to act as a pre-employment screening process and better prepare for in-person interviews. The test will highlight the strongest candidates possessing the highest level of core skills.

Yes, simply sign up (no credit card is required) and we'll give you unlimited access for seven days. Create as many jobs and test as many candidates as you want; you won't be charged a penny.

Neuroworx operates on a monthly or annual subscription basis. We have several plans to suit your hiring needs, which you can check out here. Alternatively, you can get in touch with us to discuss a custom plan.

Social worker tests are designed to assess candidate aptitude in the skills necessary to work as a successful social worker.

An insurance agent test is designed to assess candidates across the key skills needed to be successful working as an insurance agent.

Evaluate a Hotel Manager's operational and service excellence with our scenario-based test.

Evaluate CTO candidates' strategic and technical leadership through scenario-based challenges.

Talk is cheap. We offer a 7-day free trial so you can see our platform for yourselves.

Try for free