Enrolled Agent Test

An enrolled agent is an important addition to a business to ensure that tax returns are completed fully and on time, with expert knowledge on deductions and exceptions in line with IRS rules and regulations.

Insurance underwriter tests help prospective employers to evaluate whether job applicants have the essential traits and skills to be effective insurance underwriters.

Try for freeAn insurance underwriter test helps recruiters assess whether a candidate meets the skills and requirements needed to be successful in insurance underwriting. The test helps assess a variety of skills such as general insurance and product knowledge, attention to detail, error checking and situational judgement.

The test involves answering a series of multiple-choice questions, the results of which can then be used to shortlist the top candidates from your talent pool. Topics might include insurance underwriting vocabulary, knowledge of insurance products, legal aspects of insurance as well as situational judgement questions (eg identifying which insurance product suits a customer best in different scenarios).

Performing well on this test demonstrates a candidate has the required traits and abilities to be an insurance underwriter for any insurance business.

Insurance underwriters work in a range of financial organisations to help analyse risk, decide policy terms, calculate premiums and works with statistical and background information to make judgement calls and decisions.

Using an insurance underwriter test can help assess the quality and skills of each applicant that has applied for the role, to ensure they meet the criteria you require.

Shortlisting quality insurance underwriter applicants can be challenging, especially when using traditional methods of recruitment that tend to be weighted more toward experience than skills. There is also the additional challenge of choosing between candidates with similar levels of experience.

With Neuroworx's insurance underwriter test, you can assess candidates on the essential expertise required for an insurance underwriter position, such as writing skills, attention to detail, and knowledge of insurance products.

All applicants are administered with the same test, which will allow you to compare each test score and assess a candidate's core strengths and weaknesses. Those who perform well on the test can be shortlisted, where more time can be invested in the next rounds of hiring such as interviewing and assessment centres.

An insurance underwriter test could be useful for the following roles:

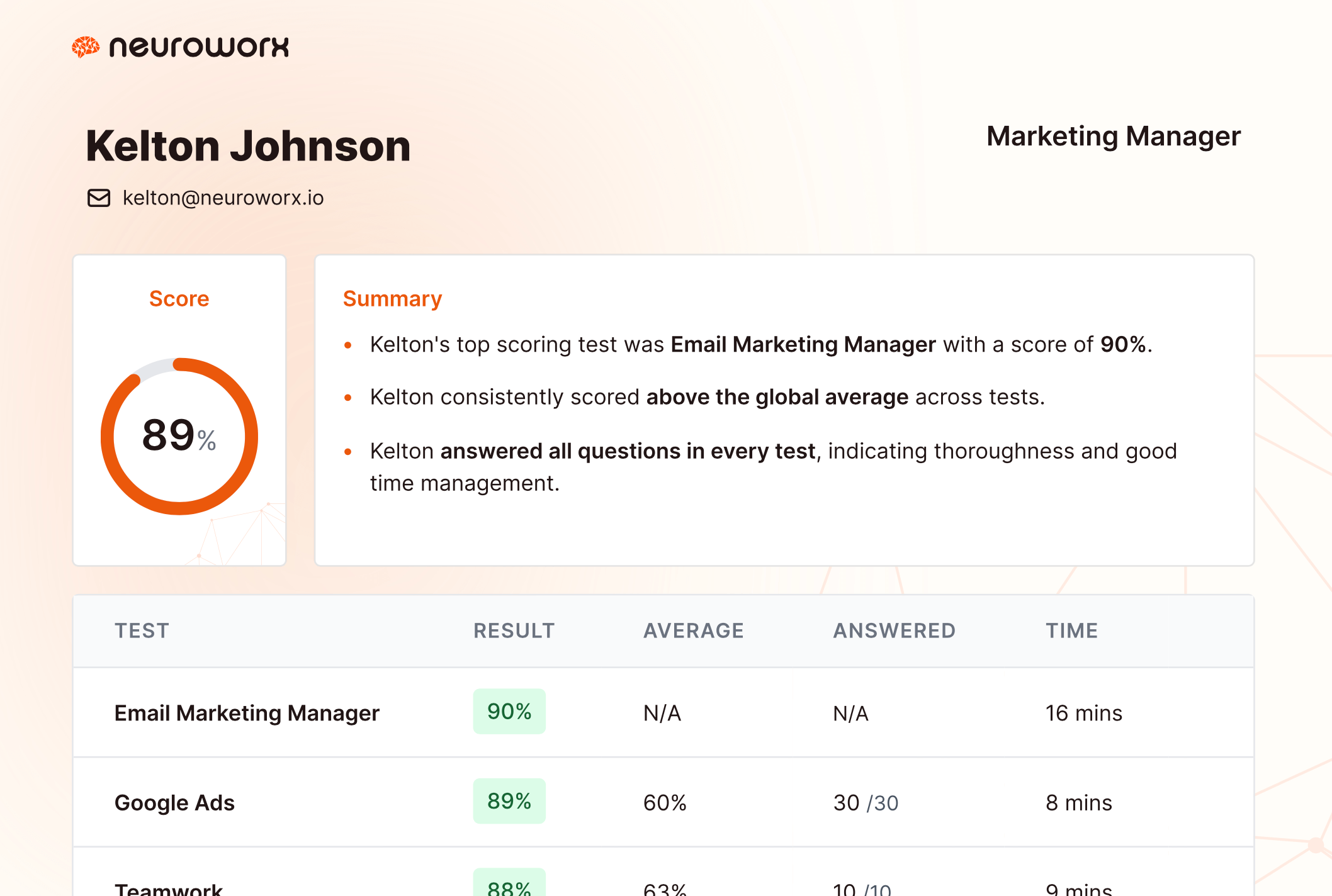

Results for the Insurance Underwriter Test along with other assessments the candidate takes will be compiled to produce a candidate report.

The report is automatically generated and available both online and as a downloadable pdf so they can be shared with other team members and employees alike.

Candidates will need to answer a range of questions that measure industry-specific technical skills where applicable (e.g.Microsoft Excel), soft skills (e.g. interpersonal skills), aptitude (e.g.numerical reasoning) and relevant personality dimensions (e.g. detail orientation). The results present a holistic view of how well suited each candidate is for the job at hand, using a data-driven approach.

The format varies by type of question, including multiple-choice for aptitude and technical skills, situational judgement for soft skills and agreement on a Likert scale for the personality dimensions. This approach ensures candidates are being assessed in an accurate and fair manner, and that results reflect the true underlying qualities of each candidate.

The characteristics, abilities and knowledge necessary to be an insurance underwriter were identified using the US Department of Labor's comprehensive O*NET database. O*NET is the leading source of occupational information that is constantly updated by collecting data from employees in specific job roles.

During the development process, test questions were rigorously analysed to maximise reliability and validity in line with industry best practices. They were created by our team of I/O psychologists and psychometricians – who collaborated with subject-matter-experts – and field-tested with a representative sample of job applicants who have varying experience, just like you might find in a talent pool.

Each test is reviewed by a panel of individuals representing diverse backgrounds to check for any sensitivity, fairness, face validity and accessibility issues. This ensures each candidate has a fair chance of demonstrating their true level of expertise.

Our insurance underwriter test is monitored to ensure it is up-to-date and optimised for performance.

Our test platform

Our platform offers an extensive library of hundreds of tests, giving you the flexibility to select and combine them in any way that suits your hiring needs. From understanding specific role requirements to assessing general cognitive abilities, our diverse library ensures you can tailor your assessment process precisely.

You might want to consider using software skill tests and soft skill tests, in addition to the insurance underwriter test. This should help provide further insight into a candidate's skills and competencies.

An insurance underwriter test is typically used during the early stages of the recruitment process (also known as pre-screening or pre-employment). Using the test early helps shortlist quality candidates who you can invest more of your time interviewing and assessing further.

Neuroworx operates on a monthly or annual subscription basis. We have several plans to suit your hiring needs, which you can check out here. Alternatively, you can get in touch with us to discuss a custom plan.

Yes, simply sign up (no credit card is required) and we'll give you unlimited access for seven days. Create as many jobs and test as many candidates as you want; you won't be charged a penny.

An enrolled agent is an important addition to a business to ensure that tax returns are completed fully and on time, with expert knowledge on deductions and exceptions in line with IRS rules and regulations.

Quickly gauge HR Coordinators' skills with real-world scenario-based tests.

Patient care technician tests are designed to assess candidates on the range of essential skills and competencies required for a patient care technician position, helping employers to make better hiring decisions.

The millwright test helps employers and recruiters to assess prospective employees on their mechanical maintenance knowledge and skills.

Talk is cheap. We offer a 7-day free trial so you can see our platform for yourselves.

Try for free