Promoter Test

A promoter test is an assessment of whether an individual demonstrates the essential skills needed to be a successful promoter.

Loan officer tests are designed to assess whether a candidate possesses the necessary skills and aptitudes to be successful in a loan officer position.

Try for freeFor recruitment teams looking to hire a loan officer, the loan officer test is a way of assessing a candidate based on the skills, attributes, knowledge and experience that are relevant to the role. With quantifiable data that gives an objective view of what each candidate already knows about the job role, recruiters can reduce their workload and choose only the very best applicants to take forward in the recruitment process.

A loan officer needs to be analytical and have great communication skills, as they will be supporting customers through the application process while assessing their credibility and financial position. It is a position that might not need a specific qualification, but it does require a good working knowledge of financial terms, numeracy, and IT skills.

Using a loan officer test to ensure that candidates possess job knowledge that is needed for the role is a simple and effective way to reduce the cost of hiring and ensure that the potential employees put forward for an interview have the key skills to be successful.

A job knowledge test, like the loan officer test, is designed to be used as part of the recruitment process. Best used early on - usually after the initial paper sift through the application forms and CVs - the loan officer test is available to candidates through a link sent in an email.

This test can be completed by the applicant, at home and in their own time. The results are available immediately to the recruitment team, providing an unbiased data point that can be used to select the best candidates.

The questions asked in the assessment are specifically relevant to the role of a loan officer. This means that the candidates who score highly in the test have the right job knowledge, and therefore are more likely to be successful in the role if they are hired - effectively reducing the cost per hire and the amount of hours spent on the process.

Loan officers need a specific set of skills to be successful, and as there is not a standardised qualification that can be used to ensure job knowledge, it can be difficult to see which applicants have the skills from just their application forms and CVs alone.

Even if the job posting has set criteria, recruitment teams can often find that they are left with an unwieldy candidate pool who all seem to be similarly qualified on paper, and then they need to put dozens of applicants through the interview process - which is costly in terms of both time and money.

By using a loan officer test, the recruitment team can put a candidate through their paces with relevant, job-related questions. The results are then a completely unbiased, quantifiable way to narrow down a candidate pool and ensure that quality candidates are taken through to interview.

The loan officer test is simple to administer to any number of candidates, and the applicant can complete the assessment when it suits them best. The results are available immediately for the recruitment team, and offer relevant data that reduces decision-making time. As every candidate answers the same questions, the results are completely unbiased and based only on what they know.

Loan officer tests are designed to be challenging but not impossible, and the results demonstrate exactly what each candidate is capable of in terms of their job knowledge, skills and aptitude for further learning. This is important when you want a loan officer to follow a specific process when helping customers with their application.

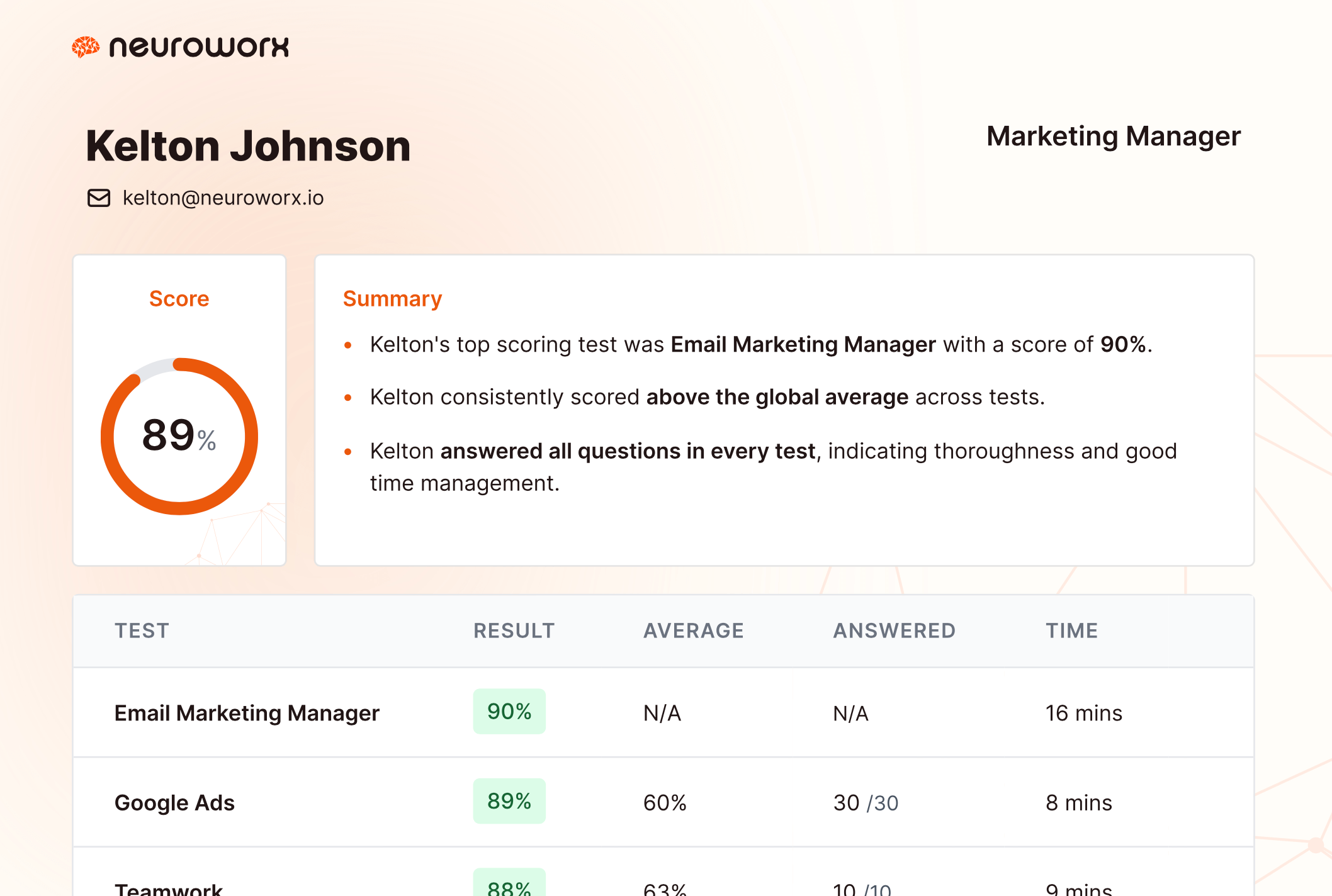

Results for the Loan Officer Test along with other assessments the candidate takes will be compiled to produce a candidate report.

The report is automatically generated and available both online and as a downloadable pdf so they can be shared with other team members and employees alike.

Candidates will need to answer a range of questions that measure industry-specific soft skills where applicable (e.g. interpersonal skills), aptitude (e.g. verbal reasoning) and relevant personality dimensions (e.g. sociability). The results present a holistic view of how well suited each candidate is for the job at hand, using a data-driven approach.

The format varies by type of question, including multiple-choice for aptitude and technical skills, situational judgement for soft skills and agreement on a Likert scale for the personality dimensions. This approach ensures candidates are being assessed in an accurate and fair manner, and that results reflect the true underlying qualities of each candidate.

The characteristics, abilities and knowledge necessary to be a loan officer were identified using the US Department of Labor's comprehensive O*NET database. O*NET is the leading source of occupational information that is constantly updated by collecting data from employees in specific job roles.

During the development process, test questions were rigorously analysed to maximise reliability and validity in line with industry best practices. They were created by our team of I/O psychologists and psychometricians – who collaborated with subject-matter-experts – and field-tested with a representative sample of job applicants who have varying experience, just like you might find in a talent pool.

Each test is reviewed by a panel of individuals representing diverse backgrounds to check for any sensitivity, fairness, face validity and accessibility issues. This ensures each candidate has a fair chance of demonstrating their true level of expertise.

Our loan officer test is monitored to ensure it is up-to-date and optimised for performance.

Our test platform

Our platform offers an extensive library of hundreds of tests, giving you the flexibility to select and combine them in any way that suits your hiring needs. From understanding specific role requirements to assessing general cognitive abilities, our diverse library ensures you can tailor your assessment process precisely.

The content of the loan officer test is meant to be challenging, but for an applicant who has the required skills and aptitudes the questions are quite straightforward. For most qualified applicants, the challenge comes from the nature of the test - answering questions under time pressure - which resembles the way they will need to perform in the workplace.

Loan officers need to have IT skills, as well as solid financial knowledge. They need to have great interpersonal skills including communication and customer service, and they need to be analytical and able to make logical decisions in sometimes emotional situations.

Neuroworx offers monthly or annual subscriptions for businesses of all sizes, so choose one that best fits your needs. You can check out our subscription plans here.

Yes, simply sign up (no credit card is required) and we'll give you unlimited access for seven days. Create as many jobs and test as many candidates as you want; you won't be charged a penny.

A promoter test is an assessment of whether an individual demonstrates the essential skills needed to be a successful promoter.

Assess Financial Adviser candidates' soft skills through real-world scenarios and dilemmas.

A telemarketer usually makes cold calls on behalf of a business to get people to become customers. They may sell a product or a service, or solicit donations. Telemarketers need to be confident communicators with excellent negotiation skills.

Executive assistant tests help employers evaluate whether a candidate has the necessary skills and traits to be a successful executive assistant.

Talk is cheap. We offer a 7-day free trial so you can see our platform for yourselves.

Try for free